The Families First Coronavirus Response Act (“FFCRA”) went into effect April 1, 2020, and will remain in effect until December 31, 2020. FFCRA created FMLA + and Paid Sick Leave. The Family and Medical Leave Act (“FMLA”) went into effect on February 5, 1993, and will remain in effect after December 31, 2020.

There are three requirements for an individual to be eligible for leave under FMLA, FMLA +, or Paid Sick Leave:

1) A covered employer;

2) An eligible employee;

3) A qualifying reason for leave

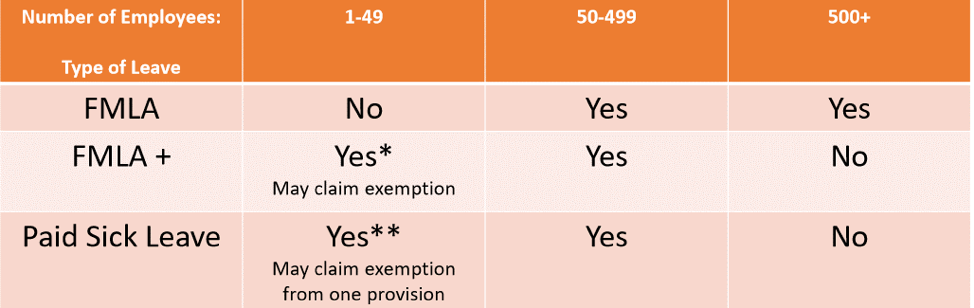

For purposes of FMLA, a covered employer is an employer with 50 or more employees. For FMLA + and Paid Sick Leave, a covered employer is an employer with fewer than 500 employees. Small businesses, with 49 or fewer employees, may request an exemption from FMLA +, and from one provision of paid sick leave.

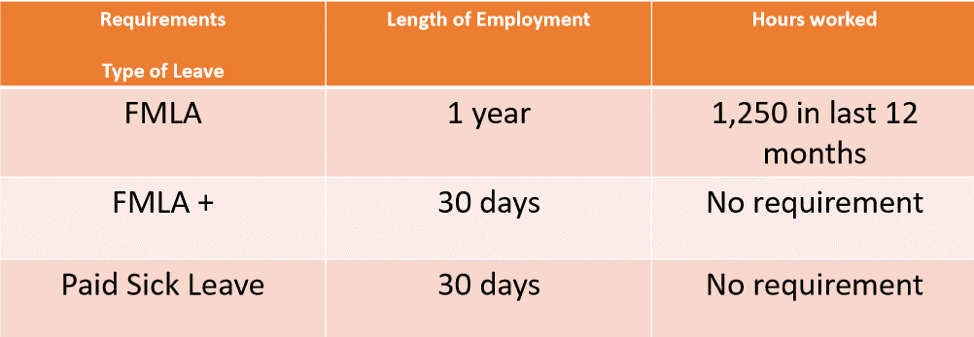

For purposes of FMLA, an “eligible employee” is one who has been employed with the company for 12 months and has worked at least 1,250 hours in the 12 months before starting FMLA leave. For purposes of FMLA+ and Paid Sick leave, an “eligible employee” is anyone who has been employed with the company for 30 days.

Qualifying reasons for FMLA, FMLA+, and Paid Sick leave are all different (with one exception):

FMLA:

a) the birth of a child and to care for the newborn child within one year of birth;

b) the placement with the employee of a child for adoption or foster care and to care for the newly placed child within one year of placement;

c) to care for the employee’s spouse, child, or parent who has a serious health condition;

d) a serious health condition that makes the employee unable to perform the essential functions of his or her job; or

e) any qualifying exigency arising out of the fact that the employee’s spouse, son, daughter, or parent is a covered military member on “covered active duty.”

FMLA+:

a) the child’s school or place of care has been closed due to COVID-19, or

b) the child’s care provider is unavailable due to COVID-19.

Paid Sick Leave:

a) is subject to a Federal, State, or local quarantine or isolation order related to COVID-19;

b) has been advised by a health care provider to self-quarantine due to concerns related to COVID-19;

c) is experiencing symptoms of COVID-19 and seeking a medical diagnosis;

d) is caring for an individual who is subject to an order to quarantine or self-isolate or has been advised by a health care provider to self-quarantine due to concerns related to COVID-19;

e) is caring for a son or daughter, if the school or place of care of the son or daughter has been closed, or the child care provider of such son or daughter is unavailable, due to COVID-19 precautions;* or

f) is experiencing any other substantially similar condition specified by the Secretary of Health and Human Services in consultation with the Secretary of the Treasury and the Secretary of Labor

*Note that qualifying reason (e) for paid sick leave is the same as the qualifying reasons for FMLA+. This is the one provision of Paid Sick Leave for which a small business may request an exemption. This also means that an individual can qualify for both FMLA+ and Paid Sick Leave at the same time.

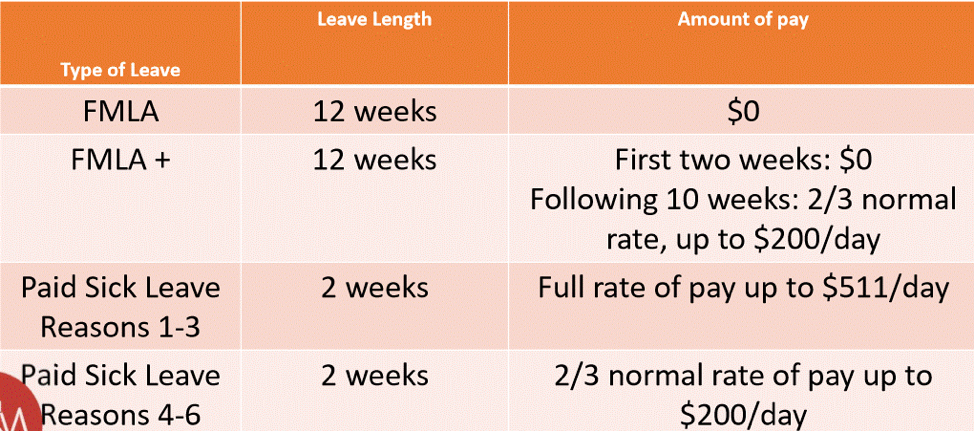

If there is a 1) qualified employer, 2) eligible employee, and 3) a qualifying reason for leave, the amount of leave and pay (if any) varies by type of leave as follows:

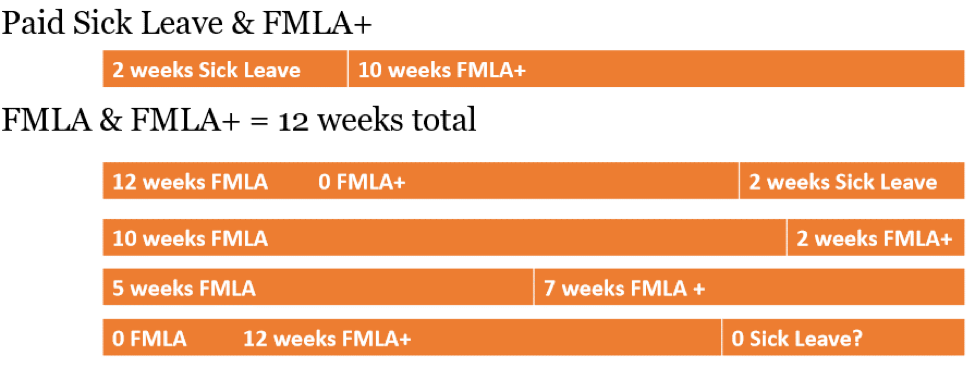

If you qualify for Paid Sick Leave under qualifying reason (e) and FMLA + you can elect to take Paid Sick Leave and the first two weeks of FMLA+ concurrently, so that the first two weeks of unpaid FMLA + is paid via Paid Sick Leave. In a 12 month period you may use only 12 weeks total of FMLA and FMLA+. However, if you have already exhausted your FMLA you are still entitled to Paid Sick Leave: